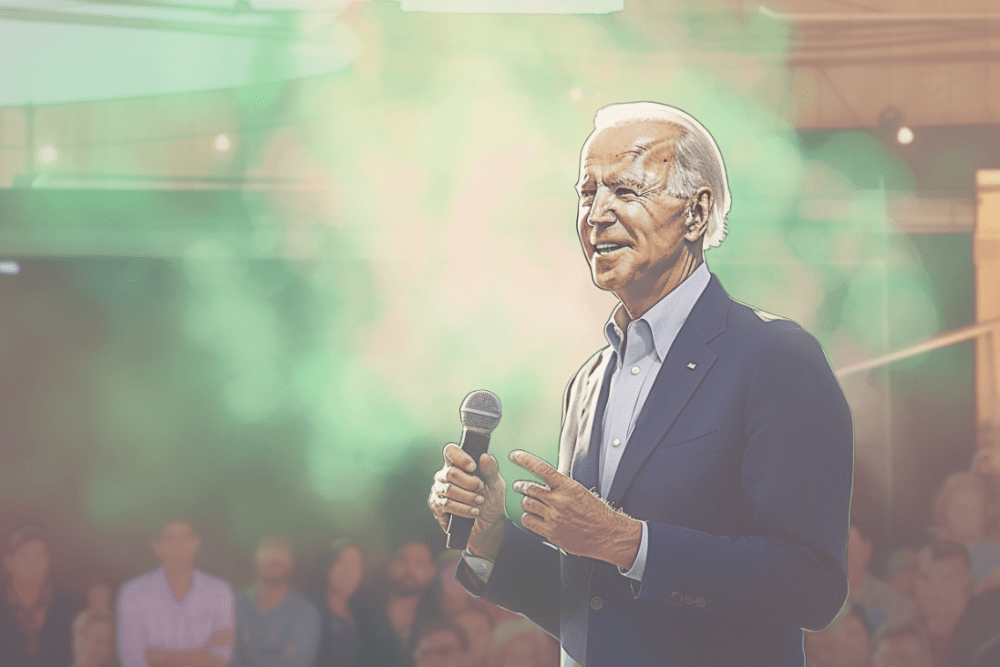

On Wednesday, U.S. President Biden decided to forgive $10,000 in school debt for borrowers with annual incomes of $125,000 and households with annual revenues of $250,000 or less. In addition, the freezing period for student loan payments will be expanded to December 31.

Many student borrowers saw their lives improve following President Joe Biden’s announcement during the year that he would forgive $10,000 in student debt for eligible borrowers and lengthen the payment pause on federal student loans through the rest of this year.

To become eligible for this rebate, any individual borrower must have an income under $125,000 per year or under $250,000 per year for couples. In addition, Biden announced that he would give up to $20,000 back to individuals who borrowed funds through the low-income student-only Pell Grant program. The break for repayment has been lengthened for a “last time” to December 31, 2022.

The initiative will carry out a campaign promise made by Mr. Biden almost 2 years ago. Numerous borrowers have been anxious, disgruntled and impatient over the President’s inaction over the past several months, and a few wondered if student aid would materialize. According to recently released federal data, about 43 million U.S. students owe $1.6 trillion in federal school loan debt.

According to Robert Farrington, creator of The College Investor, a web-based organization offering advice and information on school loans, the Biden administration is “trying to offer real help to those in need.” “Nonetheless, its execution worries me,” he said. The department of education stated that borrowers will be given until the end of the year to request debt forgiveness.

Despite legal challenges, not all specifics on the ways Joe Biden will implement across-the-board student debt forgiveness have been revealed. However, experts say a relief of about $10,000 – $20,000 could significantly impact many Americans’ lives with a debt load from student loans.

Below is the necessary information and financial steps to take if you are eligible for school loan forgiveness.

Financial Steps to Take if You are Eligible for School Loan Forgiveness

As a first step, specialists recommend capitalizing on the break on federally funded loans until the year’s end. During this time, focus on other significant financial matters, such as setting up a rainy day fund, paying off debts with high interest or putting money into a conventional retirement plan. These things will help you grow your money sooner rather than later.

With a better idea of debt forgiveness and extended payment breaks, you’ll feel more comfortable planning ahead and achieving your financial goals.

| Suppose you meet the requirements for debt forgiveness. In that case, you should refresh your contact details with the managing organization of your loan, keep an eye on your email or mail for updated loan information, and budget for the possibility of reduced monthly school loan payments starting next year. |

Identifying How Much Debt You Have

Make a detailed list of everything you owe in student loans, carefully listing the name of the loan servicer, unpaid balances, monthly minimum payments as well as interest rates. This way, you’ll know where to turn for help, including a request for debt forgiveness, payment deferment, consolidation or a repayment plan based on income.

Focus on Savings

Over the past three years, we’ve realized that building a rainy day fund is essential, so you should set one as early as possible if it still needs to be implemented. Develop a written plan and think about how you can set aside some cash every month to help you in the future, specifically if you don’t have student loans in repayment at this time.

As a rule of thumb, professionals suggest saving an amount equal to 3 to 6 months of expenses. Be aware that your budget per month may have increased recently, as inflation is near a 40-year high.

Also, think about what you plan to do in the coming years. You could be putting money aside as a down payment on a home, for your children’s education or retirement. Regardless of the goal, it’s possible to get cash now into a high-interest savings account or a CD with a short-term maturity during the break in school loan payments.

Handling Higher to Lower Interest Debts

According to Dan Casey, creator of Bridgeriver Advisors, a firm offering investment advice, cancelling your student loans will likely lower your monthly loan payments or even eliminate them.

Use the money available to pay off other high-interest debts, such as credit card debt or other personal loans. Assuming you are financially healthy, have a stable income, and are looking for relief on your outstanding private school loans, focus on those with the highest rates first. Stay ahead of potential money challenges by contacting the bank and requesting a refinance or modification of your private loans at a cheaper rate.

Get a Head Start on Your Future Investments

If this debt has compromised your retirement savings ability, take your extra monthly income that isn’t spent on school loans and put it into an IRA (Individual Retirement Account), 401(k) or other plans for retirement savings.